With businesses and schools having moved people to remote work and learning environments, it became even easier to lose track of equipment. Companies were already losing thousands if not millions of dollars in equipment a year already. This raises the question as to where do you start to stop the loss of all these devices. When it comes to accounting purposes, fixed assets have a specific meaning. There are different types of fixed assets, but the ones mentioned in this article will be physical assets. These also have to have the expectation of being used for longer than one year and be involved in the direct operation of your company.

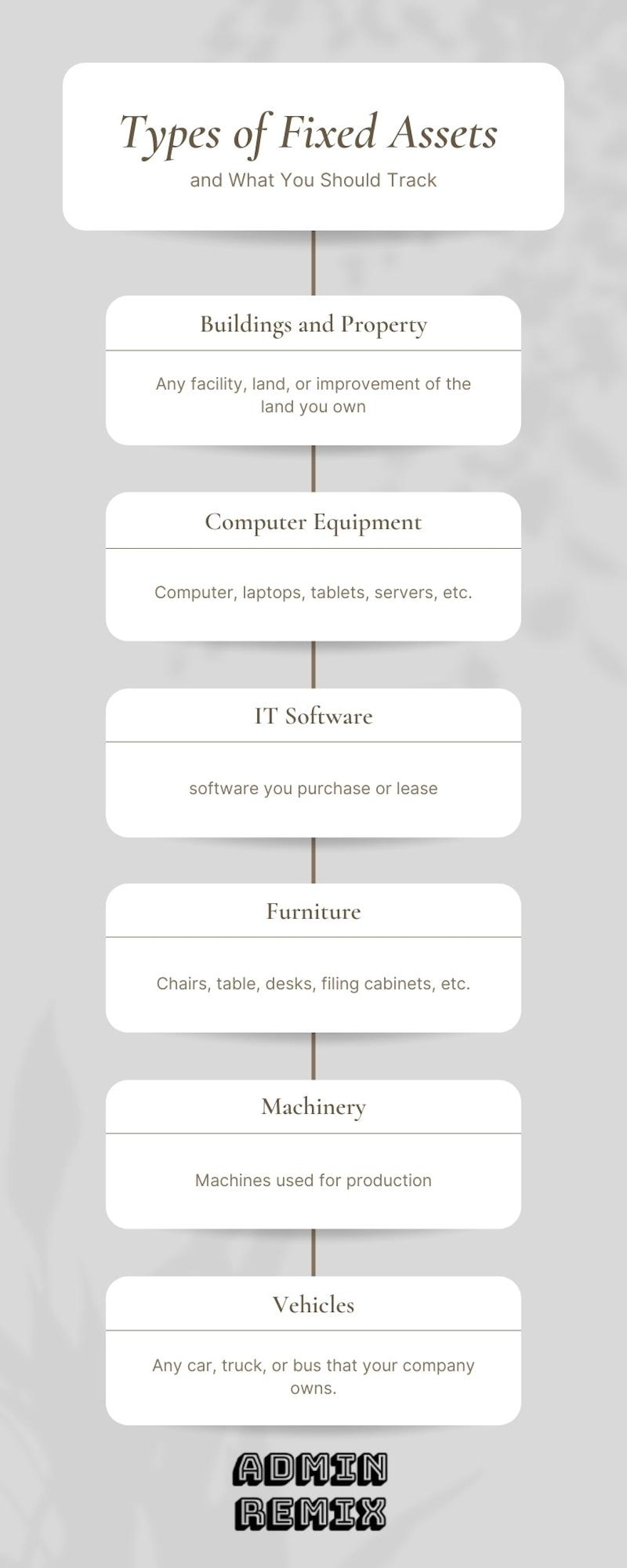

Types of Physical Fixed Assets

Buildings: Any facility you own. Computer Equipment: Computer, laptops, tablets, servers, etc. IT Software: software you purchase or lease. Furniture: Chairs, table, desks, filing cabinets, etc. Property: Any land or improvement of the land you own. Machinery: Machines used for production Equipment: tractors, mowers, printers, copier, etc. Vehicles: Any car, truck, or bus that your company owns.

You have static items included here such as buildings and land, items that do not move. However, it is still important to know the cost of such items, and know the depreciation on them for tax purposes. All the other items on the list are normally distributed to the company's employees and may not stay in one place. Tracking these items helps the accountability on the items and helps keep track of purchases for tax purposes.

What Fix Asset Aspects Should You Track?

After you create a list of the different types of fixed assets that you have, it is important to keep the data up-to-date in areas such as who has the item, if it needs maintenance, and what is its schedule like for maintenance. Many of these relate to your fixed assets computer equipment, or any technology related assets.

When tracking assets, the basic information that you should track is as follows:

1. Serial Number

2. Asset ID

3. Purchase Cost

4. Person assigned to

5. Location of asset

6. Warranty expiration

7. AUE expiration(Chrome OS devices)

What are not Fixed-assets?

Whatever your company purchases that it does not intend to use for more than a year is not a fixed asset. If your company sells products, those are not fixed assets.

Consumables

Consumables are a type of asset that is not set to return to stock after use. You need to track these so that you can keep a running count of how many you have available. Examples of consumables would be printer ink, printer paper, screw, etc. These are all items that get used that are not able to be reused.