Effective management of assets is fundamental for an organisation to improve operational efficiency, reduce expenses, propel business agility, and maximise ROI. Asset lifecycle management (ALM) is an essential part of that process. In this article, we explain the importance of ALM by breaking down its different stages and highlighting the best lifecycle management practices to optimise your asset utilisation.

Define Asset Lifecycle Management

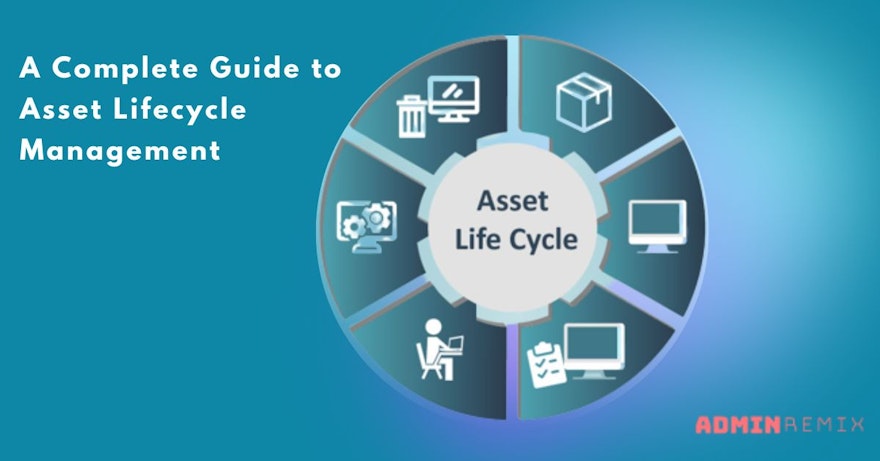

Asset lifecycle management is a systematic approach for managing an organisation's assets throughout its lifespan, from procurement to retirement or disposal. It involves a series of activities, like:

Planning

Acquisition

Tracking

Maintenance

Upgrades

Retirement

Asset disposal

The goal is to ensure:

Optimum utilisation of assets

Operational cost reduction

Regulatory compliances

Risk assessment and resolution

Asset lifecycle management can be enhanced by leveraging technology, implementing standardised processes, and conducting regular audits to achieve maximum value from assets.

Significance of Asset Lifecycle Management for Organizations

ALM is important for organisations big and small, across industries to optimise asset usage. It empowers businesses by:

Enhancing the visibility of all existing assets to help with effective planning of purchases, usage, upgrades, and disposal.

Enabling better asset procurement via improved asset visibility. It helps organisations track maintenance, license and warranty renewal of assets to make smart procurement decisions.

Preventing unnecessary purchases and identifying underutilised assets, thus optimising operational costs.

Improving productivity by making the right assets available to the right people when the time calls for it, thus reducing downtime.

Ensuring regulatory compliance via accurate asset data and risk assessment associated with loss or theft of assets and maintenance failures.

Providing valuable insights for better decision-making via accurate data analysis on asset procurement, maintenance schedules, and disposal strategies.

Different Stages Involved in Asset Lifecycle Management

Asset lifecycle management involves multiple stages mentioned below:

Planning

The first stage of asset lifecycle management involves identifying the asset needs for specific operations by collaboration across multiple departments. It is followed by planning the procurement, budgeting, and negotiating contracts with vendors regarding asset acquisition.

Acquisition

The next stage is acquisition or purchase of the assets, as per the initial planning. Negotiation often permeates in this stage to acquire the best asset at reasonable prices.

Deployment

Once the assets are acquired it's time to deploy them to concerned personnel. Using asset management software is essential at this stage. It allows administrators to import asset data into the system and keep track of the check-in/out details, ensuring accountability amongst users.

Utilisation

After the assets are deployed to concerned users, the asset management software is used for asset tracking, monitoring performance, and proper utilisation.

Maintenance and Repair

Assets require regular maintenance and repair to improve their performance and longevity. This stage involves scheduling and performing preventive and corrective maintenance, managing spare parts, and tracking maintenance costs.

Upgrades

Assets require upgrades or enhancements from time to time to extend their lifespan, improve performance, or comply with changing regulations. Hence, appropriate evaluations are done to implement enhancements.

Retirement & Disposal

At the end of their lifespan, assets are retired and disposed of properly. It involves decommissioning assets, disposing them in an environmentally responsible manner, and managing any data or security risks associated with asset disposal.

Best Practices Involving Asset Lifecycle Management

Now, coming to the best ALM practices! Here are a few ways that you can improve asset utilisation throughout its useful lifespan.

1. Register all of your assets accurately

When tracking your assets, you need the following data:

Location

Purchase price and date of procurement

AUE date

Depreciated value for both tax and accounting purposes

It’s important to register all your assets accurately along with relevant data, and update it regularly.

2. Compliance with current federal TAX rules

It is very difficult to keep up with the ever-changing federal tax codes. This, however, can be beneficial to businesses as they can find numerous tax breaks available to them, by staying compliant with the latest TAX rules.

3. Calculating accurate tax and generally accepted accounting principles (GAAP)

It can be time-consuming to go back and forth between multiple different depreciation methods and calculations for your assets. Having an automated system helps improve accuracy on tax changes, while also freeing up your staff and allowing them to focus more of their time on improving productivity. This helps in eliminating productivity drains and your business can take advantage of the alternative depreciation system (ADS) rules and other parts of the Tax Cuts and Jobs Act. Staying on top of this will help you to stop overpaying taxes for devices that have been decommissioned and are no longer used by your company.

4. Accurately report your IRS forms, depreciation expense, general ledger, and roll your reports forward

Having inaccurate data on IRS forms 4562 and 4797 has a major impact on your reporting. This affects your period closing, financial statement, and tax reporting. Having accurate asset information can save your business from large penalty fees and cracks in the foundation of your finances.

5. Accurate accounting of retirements, disposals, and transfers

Ensuring accurate information on retirements, disposals, and transfers saves you from the accumulation of zombie and ghost assets. As stated before, businesses can have up to thirty percent of zombie or ghost assets in the fleet. This can easily cost your business thousands of dollars in unnecessary expenses.

6. Forecasting fixed assets as you expand

As your company grows, and takes on more projects, it is important to be able to forecast how many devices you will need for each project, and any additional ones you might need for people in support roles.

7. Set a budget for assets

It is important to set a budget for your assets as it adds additional accountability that will help your company not overspend and reduce the over/underpayment on depreciation.

8. Track your cost and spend against your budget

Use reports to plan any future projects or expansions so that you have an accurate forecast of what this expansion will cost. Asset management software, like AssetRemix, helps gather valuable insights on asset lifecycle management through custom reporting.

Importance of Using Software for Asset Lifecycle Management

If your company is using spreadsheet or legacy software, there is only so much you can do in terms of lifecycle management. Using spreadsheets lacks an audit trail. The only thing you can track is who last edited the sheet, as all modifications to devices have to be entered manually. This means that spreadsheets can have accidental changes or inaccuracies that can compromise the integrity of the data you are keeping. That’s where the significance of an integrated ITAM system comes to play.